The financial sector is associated with big numbers, meticulous work and mistakes that could cost millions. It comes as no surprise that the procedures are very precise and require a lot of effort to ensure there are no slip ups. Therefore in this sector, IT solutions are irreplaceable in helping to manage large corporations, navigate international laws and keep track of what is happening locally.

The financial sector is associated with big numbers, meticulous work and mistakes that could cost millions. It comes as no surprise that the procedures are very precise and require a lot of effort to ensure there are no slip ups. Therefore in this sector, IT solutions are irreplaceable in helping to manage large corporations, navigate international laws and keep track of what is happening locally.

It comes as no surprise that the IT spending in the financial sector has been growing over the last years. Which is caused not only by the initial demand, but also by the fact that the last time this sector heavily invested in IT was in the 90’s. By now most of the systems need to be patched up, reworked or completely switched out.

Besides the need to update, there are several other factors due to which the IT expenses are growing. Consumer expectations of mobile and electronic banking are ever expanding and to satisfy this demand, the sector needs to innovate. As well as that, there are a lot of acquisitions and mergers happening in the sector. This means work practices are being merged into one or adapted to each other, which almost always requires to update the systems. It is actually this reason that is at most interest to us, as project management software manufacturers and it is the one we are going to explore.

Naturally, with this demand, it is curious to see what sort of systems the financial sector is investing in. For us particularly, it is important to understand what the financial sector is looking for and what type of project management approach will be applied going forward.

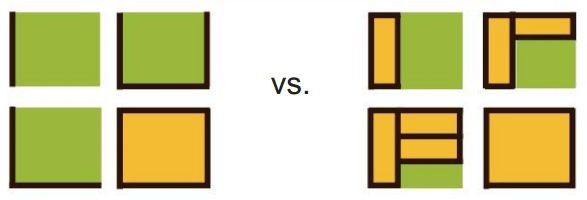

Traditionally, most of the financial sector has trusted was the waterfall project management approach – it moves slowly, is well documented and gives time to evaluate important decisions. This has worked well in the sector and some of you might say – why should we fix what is not broken? And indeed you should not, instead you should try and understand if this process is still the best for you in te current market conditions. We suggest to take a look at a couple examples on how moving on from waterfall to scrum changed the business of others in the financial sector. Keep in mind though, that switching from one methodology to another is never easy.

For those of you not familiar with scrum – the main difference between the approaches is that instead of completing the whole project one stage at a time, it is divided into short iterations (lasting around 2 weeks) and completed one iteration at a time going through all of the stages. You can find out more about scrum here.

From the get go we can find one major difference between waterfall and scrum – the documentation. With waterfall all the documentation is prepared at the beginning of the project and due to the sectors standards it usually takes a long time to complete. Once it is done, it should serve the whole time of the project, however the reality is often different. Since most projects tend to last quite a while, it is not uncommon for the requirements, laws and regulations to change turning the prepared documentation irrelevant. Therefore it has to be updated, taking even more time and resetting the whole project. With scrum on the other hand, the documentation is prepared for the short iterations, therefore it is a lot smaller in quantity and does not go out of date during the iteration it is used for.

It is a common perception that scrum does not support documentation. However, in reality it simply discourages excessive and wasteful documentation that does not have to be created and kept up. By applying scrum companies can save valuable time and resources otherwise spent on reworking the out of date documents.

Another benefit that scrum approach provides is fast decision making. To be more accurate – a faster one than the waterfall approach. Because only short work iterations are completed at a time, instead of the whole project, scrum allows to adopt to changes and make decisions based on those changes a lot faster. This not only gives almost instant gratification to the client, but also shortens the project time quite a bit by not having to go back to the beginning and define the whole project anew.

Capital One, a Fortune 500 firm that offers financial products that include credit cards, savings accounts, and loans for consumer and business purposes saw an average of 70% reduction in the project duration after adopting scrum. This impressive number convinced the company to apply scrum throughout the whole organization and enjoy the benefits.

Communication, coordination and control are very important in any company and especially in a newly merged or acquired one. When the processes are changing, it is important to have a system in place that accommodates all those three things. That is exactly what scrum provides. It is easy to have communication, coordination and control, when all the projects are presented in a clear way on scrum boards, with the current priorities highlighted in sprints. Opposite to waterfall, this gives the overview of the long-term and clarity for the short-term as well.

A study completed on two Danske Bank branches, one in Denmark and one in India, proved that this was a benefit they have really enjoyed. Adapting the agile approach helped them to ensure continuous communication, good coordination on the tasks and easy control they have previously lacked.

Another company that claimed these aspects were key for their success is an accounting firm Integre, UAB, from Lithuania. The approach they took was more kanban based due to the repetitive nature of tasks. We will talk more about their case in the future posts.

Despite still being seen as an approach for software developers, scrum is versatile and can offer a lot of benefits to other sectors. The financial sector is no exception. It provides clarity, reduces waste and gives company the tools to move quickly in today’s changing environment, while still being flexible enough to adapt any practices that the company needs to keep. It appears, the soon scrum will be seen as more than just software development.

Will you join?